Autonomous vehicle development is picking up momentum in ways few expected just a few years ago. From bustling streets in San Francisco to the fast-paced growth of Shanghai, self-driving cars are no longer a futuristic concept.

These vehicles are now being spotted in active traffic, while robotaxis and autonomous shuttles are becoming part of daily transport systems. The year 2025 is already positioning itself as an important period for the progress of self-driving vehicle services, with a wave of new deployments and service expansions on the horizon.

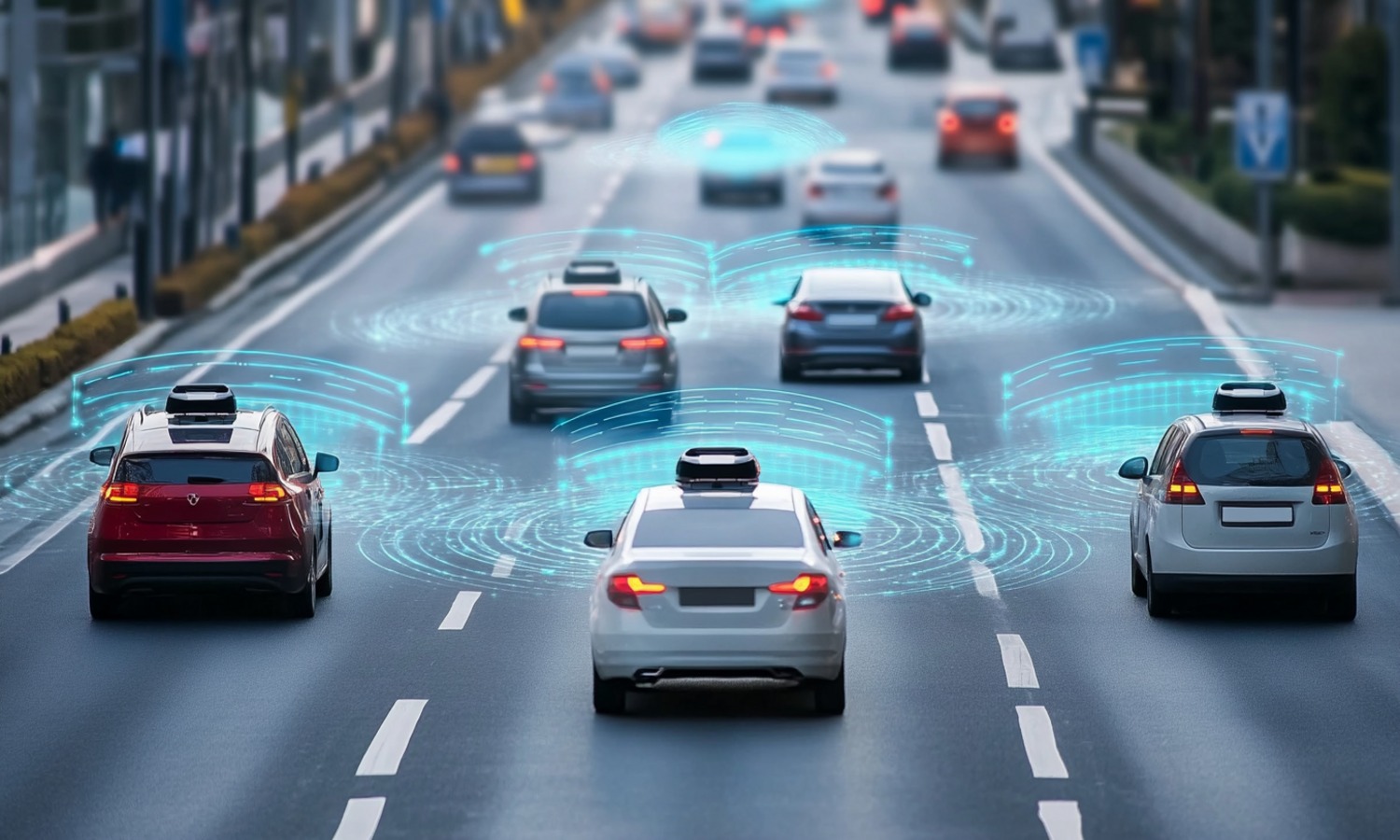

Robotaxis and autonomous shuttles are becoming everyday sights in global cities (Photo: Getty Images)

Technology firms and major car manufacturers such as Google’s Waymo, Amazon’s Zoox, Uber, Tesla, Alibaba, and Baidu are pumping in resources to make autonomous mobility safer and more efficient.

Their efforts include heavy financial backing, innovative engineering, and forming new partnerships, all aimed at making automated systems more reliable than human drivers.

As public scepticism reduces and governments update laws based on positive safety outcomes, transportation is entering a new chapter of evolution. These changes raise questions about who is leading development and how the sector might continue to change.

Waymo and Uber Grow Their Self-Driving Service Footprint

Among the most active players is Waymo, which operates under Google’s parent company Alphabet. Toward the end of 2024, Waymo grew its presence by extending its robotaxi agreement with Uber to now include Austin and Atlanta, building on their initial efforts in Phoenix.

The deal strengthens both companies by giving Uber customers access to Waymo’s autonomous cars directly through its app, helping more people experience driverless transportation.

Within the partnership, Waymo handles responsibilities such as maintaining the cars and attending to customer needs, while Uber focuses on bringing in users to the service.

Uber is using its vast user base to secure a long-term role in self-driving technology. The company has expanded its reach by forming alliances, such as its December 2024 collaboration with WeRide in Abu Dhabi (which includes a human safety driver), and other partnerships with UK-based Wayve, May Mobility, and China’s Momenta.

The company is also working with Avride to bring autonomous delivery robots to Dallas and Austin. On the other hand, one collaboration that remains unlikely at the moment is between Uber and Tesla, as Tesla prefers to continue on its independent path.

Tesla and Zoox Rely on Their Internal Efforts

Tesla has laid out bold targets in its pursuit of self-driving services. In October 2024, the company revealed the Cybercab, a compact robotaxi made for city movement.

Unlike its competitors, Tesla’s model depends on software supported by a simpler, camera-based sensor system instead of expensive lidar and radar setups. The approach uses large amounts of data collected from its vehicles already on the road, allowing its AI system to learn and adapt.

While Tesla believes in its ability to compete with companies that rely heavily on sensors, its current self-driving software has only reached level 3 automation. This level permits hands-off driving but still requires a human to be present and alert.

The situation offers an interesting comparison in the industry between Tesla’s wide-scale but less sensor-dependent vehicles and Waymo’s tightly mapped-out, sensor-rich, and geographically restricted fleet that already operates under level 4 automation.

Lyft is also steadily building its autonomous capabilities. Its partnership with May Mobility aims to roll out self-driving Toyota Sienna vans in Atlanta by the end of 2025, with plans to expand into Dallas by 2026.

Alongside this, Lyft is collaborating with Mobileye and Marubeni to launch a proprietary robotaxi, beginning in Dallas and moving to other cities in 2026.

Amazon-owned Zoox has advanced its own autonomous vehicle, which stands out by having no traditional driver controls. It’s preparing to deploy its robotaxi in Las Vegas and the San Francisco Bay Area in 2025.

Zoox recently encountered a technical issue due to unexpected braking, leading to a software recall. It’s unclear how this will affect the timing of its planned launch.

Developments in China and Across Europe

China has gained global attention for its rapid rollout of autonomous vehicles. Backed by strong support from its national authorities and clear regulations, Chinese companies have been able to move forward at a fast pace with testing, production, and service launches.

2025 is shaping up as a breakthrough year for driverless transportation services (Photo: Alamy)

Baidu’s Apollo Go, Alibaba’s AutoX, and SAIC Motors, along with joint ventures like WeRide and Pony.ai, are all preparing to launch thousands of self-driving vehicles in 2025. Baidu is even eyeing international markets as it seeks to grow beyond China.

Meanwhile, Europe is taking a different direction with its focus on autonomous systems that serve as public transport. These include roboshuttles, robovans, and robobuses that are typically used for short trips in under-served communities and limited test areas.

One innovative step in Europe has been its decision to allow multiple providers to operate under the same autonomous service system, breaking away from the traditional approach of siloed networks. Keolis, a major mobility company, has gained experience in running such a system and uses Autofleet software to coordinate between various providers.

That said, car-based autonomous services are not absent in Europe. There are trials underway in several places, just as there are in South Korea and Japan.

Challenges Still Present Across the Industry

Even with all the activity and investment in self-driving services, the sector still faces many tough hurdles. General Motors’ recent choice to pull back from the robotaxi segment and stop funding its Cruise business highlights the uphill struggle.

Western automakers must deal with strict regulators, financial uncertainty, and competition from China’s well-supported efforts, all of which hinder fast progress. Even Waymo, which is seen as a pioneer, has not yet made up the money spent on its years of development.

Because of these problems, some companies are choosing to redirect their energy. Rather than focus on robotaxis, they are turning to autonomous trucks. This switch is based on practical advantages highway environments are less unpredictable, routes are fixed, and the potential to generate quicker returns is higher.

Looking Ahead in the Self-Driving Sector

Autonomous driving continues to make headway as companies work through both legal and technological obstacles. Progress may not always be smooth, but the sector is shaping new ways for people and goods to move.

At Autofleet, we are contributing to this development with services that support every stage of autonomous mobility. Our work includes early planning, simulating demand, building infrastructure, managing fleets, setting up transport policies, running daily operations, and introducing technology for booking and dispatch all designed to support the industry’s steady advancement.